SAGA

- Details

- 32298

-

1. What is the main source of reference for SAGA?

Surat Pekeliling Akauntan Negara Malaysia Bilangan 3 Tahun 2018 – Pelaksanaan, Pemantauan, dan Pematuhan Sistem Perakaunan Standard bagi Agensi Kerajaan (Standard Accounting System For Government Agencies)

-

2. What is SAGA?

SAGA refers to Standard Accounting System for Government Agencies. SAGA is either a customized accounting and financial application system or Commercial Off-The-Shelf (COTS) as well as a support system related to financial data that integrates with it. The application system needs to comply with the accounting and financial systems design approved by Accountants General’s Department of Malaysia (AGD) and SAGA Compliance Criteria.

-

3. What is the objective of SAGA?

The objectives of SAGA are as follows:

- To ensure financial statements can be produced timely, accurate, up-to-date, integrity, comply with the relevant accounting standards, to enhance the accounting and financial management of Government Agencies; and

- To ensure the security of the system, data and information are secured in terms of confidentiality, integrity, availability, complete and accessible at any time.

-

4. Who are the Government Agencies?

Government Agencies refers to:

- Federal Statutory Bodies;

- State Statutory Bodies;

- Local Authorities; and

- State Islamic Religious Councils.

-

5. What is the governance structure of SAGA?

The governance structure of SAGA consists of:

- Accountants General’s Department of Malaysia (AGD) Level:

- SAGA Steering Committee

- SAGA Technical Committee

- SAGA Compliance Committee

- Ministry / State Secretary / Government Agency Level:

- SAGA Monitoring Committee (Ministry / State Government)

- SAGA Implementing Committee (Agency)

- SAGA Task Force (Agency)

Members and terms of reference of the governance structure of each level are as stated in Surat Pekeliling Akauntan Negara Malaysia Bilangan 3 Tahun 2018.

- Accountants General’s Department of Malaysia (AGD) Level:

-

6. Does the accounting and financial application system to be developed by the Government Agencies need to have system design approval?

Government Agencies who intend to develop accounting and financial application systems must obtain system design approval from the Accountant General's Department of Malaysia (AGD). The application with supporting documents should be completed and submitted to the Advisory and Consultancy Division, AGD as stated in Surat Pekeliling Akauntan Negara Malaysia Bilangan 3 Tahun 2018. Accounting and financial application systems developed before issuance of Surat Pekeliling Akauntan Negara Malaysia Bilangan 5 Tahun 2010 on November 26, 2010 are exempted from obtaining system design approval from AGD.

-

7. Does The Government Agencies need to obtain advice from the Chief Government Security Office (CGSO) before the accounting and financial application system been implemented?

Government Agencies should refer to the Chief Government Security Office (CGSO) to get advice and advice on the risk assessment of the system and data security before the accounting and financial application system implemented as required in the Arahan Keselamatan (Semakan dan Pindaan 2017). CGSO's advice is a compulsory document to be submitted for the application of system design approval.

-

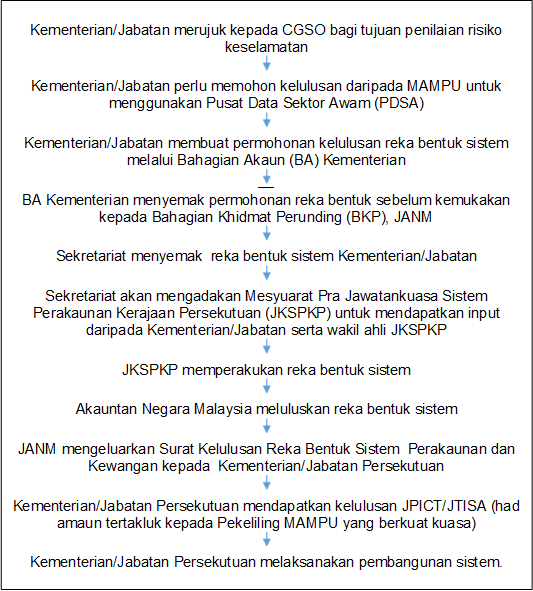

8. What are the processes involved in applying for system design approval from the Accountant General's Department of Malaysia?

The processes involved in the application for system design approval are as follows:

Government Agencies must get advice from CGSO prior to the development accounting and financial application system

↓

Government Agencies submits application for system design approval to the Advisory and Consultancy Division, AGD

↓

Government Agencies presenting the application of system design at the Pre-Approval Meeting

↓

Advisory and Consultancy Division, AGD presenting the application at the SAGA Technical Committee (JKT) meeting to be certified

↓

Advisory and Consultancy Division, AGD presenting the application at SAGA Steering Committee (JKP) meeting for approval

↓

Advisory and Consultancy Division, AGD issues approval letter of the system design to the Government Agencies

-

9.How does the pre-approval meeting for the design of accounting and financial application systems with Government Agencies is conducted during the execution of the Movement Control Order (MCO) by the Government?

Pre-approval meeting for the design of accounting and financial application systems with Government Agencies was conducted through online during the execution of the Movement Control Order (MCO) by the Government.

-

10. How long does it take to get the system design approved by AGD?

The complete application will be processed within two (2) months from the date of received. The process involves two (2) committees in AGD which are SAGA Technical Committee (JKT) for the verification and SAGA Steering Committee (JKP) for the approval of the application. The application must be submitted to the Advisory and Consultancy Division, AGD at least three (3) weeks prior to the SAGA JKT Meeting.

-

11. Does the system design approval has an expiry date?

The system design approval has no expiry date. However, the system design approval is void if the Government Agencies changed their existing system to a new accounting and financial application system.

-

12. What are the actions should be taken by the Government Agencies after obtaining the system design approval from AGD?

Upon the approval of the system design obtained from AGD, based on the General Circular issued by the Prime Minister's Department, the Government Agency shall submit the application for the system's technical approval to:

- ICT Steering Committee (JPICT) at the Ministry / State Secretary (SUK); and / or

- Public Sector Technical Committee (JTISA) at MAMPU, Prime Minister's Department. (subject to circular in force).

For Government Agencies that is not subject to such circular, they should follow their own development system rules and procedures.

-

13. What are the consequences if the Government Agencies did not seek for the system design approval from AGD?

It will affect the process of obtaining the SAGA Compliance Certificate because the system design approval is one of the compulsory requirements for the SAGA Compliance Criteria.

-

14. Does the Government Agencies required to apply for SAGA Compliance Certificate even though the Government Agencies have obtained the system design approval from AGD?

Government Agencies are required to apply for SAGA Compliance Certificate even though the agencies have obtained the system design approval from AGD. The development system at the agencies might be different from the approved system design.

SAGA Compliance Certificate will be granted to the Government Agencies which accounting and financial application systems comply with SAGA Compliance Criteria as stated in Surat Pekeliling Akauntan Negara Malaysia Bilangan 3 Tahun 2018. -

15. What are the SAGA Compliance Criteria that must be complied by the accounting and financial application systems of the Government Agencies?

The SAGA Compliance Criteria consists of 12 functional criteria and 8 technical criteria.

Functional Criteria :- General Accepted Accounting Principles

- Accrual Accounting

- Flexible Chart of Accounts

- Closing of Financial Account

- Single-Point Data Entry dan Integration

- Adding/Reducing Module

- Online Workflow

- Electronic Payments and Receipts

- Bank Reconciliation

- Generating of Financial Statements and Reports

- Auditing

- Data Storage

Technical Criteria :

- Administration of User Safety Profiles

- Audit Trail

- Log Server System

- Data Encryption

- Information Security Network and ICT Infrastructure

- Auto Logoff

- Data Back Up and Restore

- Disaster Recovery Plan

-

16. How to apply for a SAGA Compliance Certificate? What are the processes involved in the application of SAGA Compliance Certificate from AGD?

Government Agencies to complete the Self-Assessment SAGA Compliance Review (SASAR) and Checklist

↓

Government Agencies to submit SASAR and Checklist to the Advisory and Consultancy Division, AGD

↓

SAGA Secretariat conducts SAGA Compliance observation visits at Government Agencies and report the findings and recommendations for improvement

↓

SAGA Compliance Committee (JKPS) conducts assessment visits at Government Agencies for evaluation and verification

↓

Advisory and Consultancy Division, AGD presenting the compliant agencies at the Steering Committee (JKP) meeting for approval

↓

Advisory and Consultancy Division, AGD issues the recognition letter and SAGA Compliance Certificate to Government Agencies

-

17. What does the agency need to provide during the observation visit by SAGA Secretariat and the assessment visit by SAGA Compliance Committee (JKPS)?

- During observation visit by SAGA Secterariat, Government Agencies presenting the accounting and financial application systems for secretariat to view and comment for improvement before go through the assessment visit by JKPS.

- During assessment visit by JKPS, Government Agencies presenting the accounting and financial application systems for the JKPS to evaluate and verify before get approval from SAGA Steering Commitee.

-

18.How does the observation visit by SAGA Secretariat and the assessment visit by SAGA Compliance Committee (JKPS) are conducted during the implementation of the Movement Control Order (MCO) by the Government?

The observation visit by SAGA Secretariat and the assessment visit by SAGA Compliance Committee (JKPS) were conducted online during the implementation of the Movement Control Order (MCO). Preparation by the agencies are as follow:

- Required documentations are to be submitted to the SAGA Secretariat two weeks prior to the date of the visit; and

- Ensure robust internet connection to avoid any interruption during the presentation session.

-

19. How long does it take to get a SAGA Compliance Certificate?

There is no specific time frame depending on the readiness of the accounting and financial application systems. Observation visits by SAGA Secretariat conducted before the system is ready to be evaluated by the SAGA Compliance Committee (JKPS).

-

20. Does the SAGA Compliance Certificate has an expiry date?

There is no expiry date for the SAGA Compliance Certificate. However, the Certificate is void if the Government Agencies change the existing system to the new accounting and financial application systems. If the Government Agencies upgrading the system, the compliance must be maintain and non-compliance may result in the revocation of the SAGA Compliance Certificate.

-

21.Will AGD conduct an audit on the Government Agencies that have obtained the SAGA Compliance Certificate?

AGD organized follow-up visit to the Government Agencies that have attained the Compliance SAGA Certificate more than three (3) years from the date of certificate been awarded. Thus, Government Agencies must ensure the systems comply with SAGA Compliance criteria at all times.

AGD has determined that the SAGA Compliance Certificate will be revoked for government agencies that do not maintain SAGA Compliance. -

22. Who should I contact for further information regarding the application of system design approval and SAGA Compliance?

Please contact:

Advisory and Consultancy Division

Accountant General’s Department of Malaysia

Level 5, Treasury 2

No.7, Persiaran Perdana

Presint 2

62594 Putrajaya

u.p. : Unit SAGAPhone no : 03 - 8886 9543/ 9756/ 9547/ 9848/ 9751/ 9604/ 9535/9757/ 9682

Email : bkp_saga[@]anm.gov.my

Media Gallery

Media Gallery